Back

6 Jul 2022

Crude Oil Futures: Room for extra losses

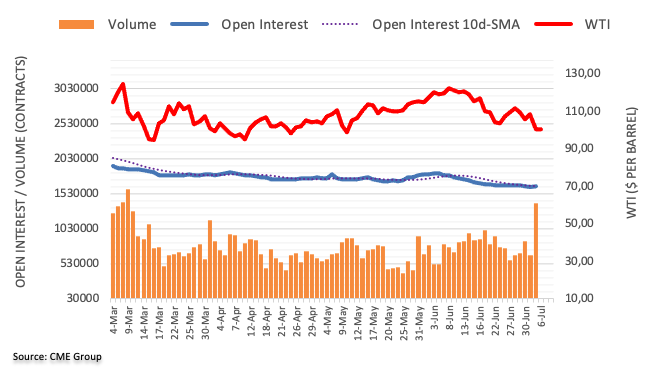

Considering advanced prints from CME Group for crude oil futures markets, open interest rose sharply by around 14.2K contracts on Tuesday. In the same line, volume reversed the previous pullback and went up by around 736.8K contracts, the largest single-day build since March 1.

WTI: Next on the downside comes the 200-day SMA

Prices of the barrel of the WTI shed nearly 9% in response to recession fears on Tuesday. The intense sell-off was in tandem with increasing open interest and volume and this is supportive of the continuation of the downtrend, at least in the very near term. That said, the next support of note emerges at the 200-day SMA, today at $93.37.