Back

17 Nov 2021

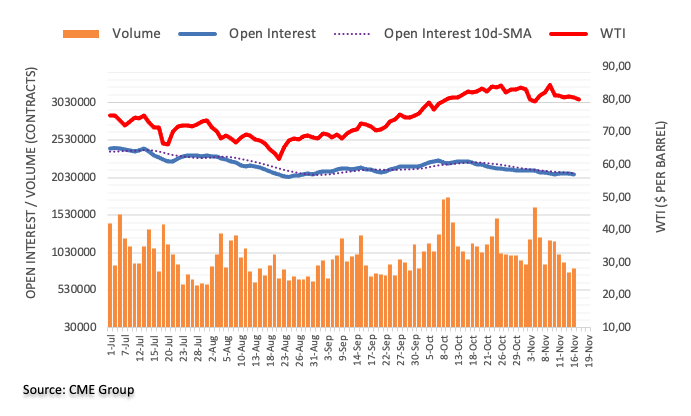

Crude Oil Futures: Decline could be losing traction

CME Group’s flash data for crude oil futures markets noted traders trimmed their open interest positions for the third session in a row on Tuesday, this time by around 13.1K contracts. Volume, instead, increased by around 48.6K contracts after four consecutive daily drops.

WTI faces support near $78.00

Tuesday’s negative price action in WTI came in tandem with shrinking open interest. Against this, the likeliness of a deeper retracement appears not favoured in the very near term. In the meantime, the monthly low at $78.28 should hold the downside for the time being.