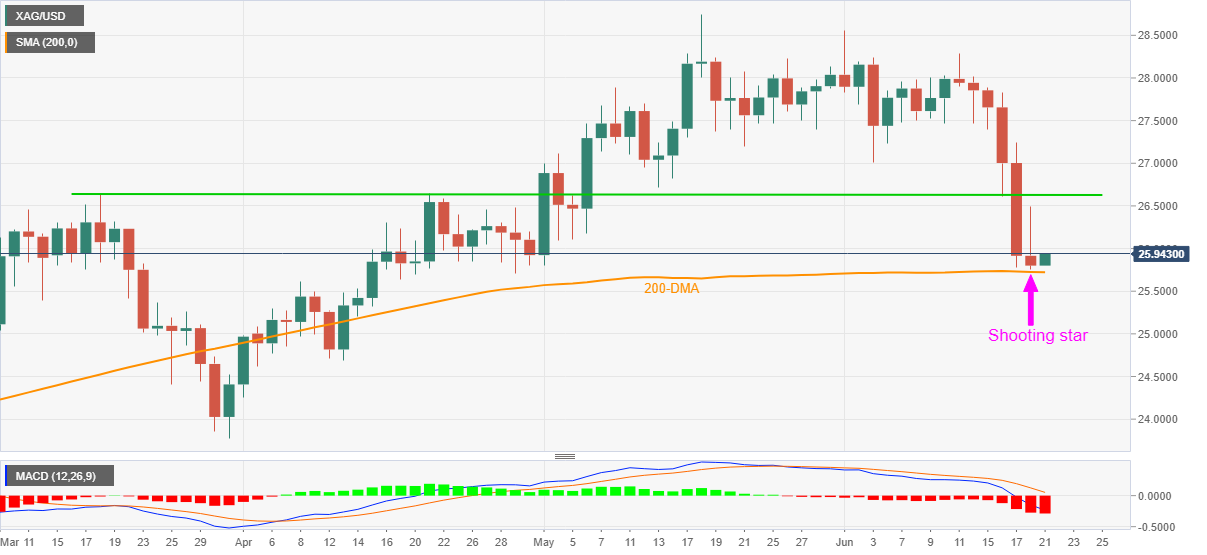

Silver Price Analysis: XAG/USD justifies shooting star above 200-DMA as bulls attack $26.00

- Silver bounces off the lowest levels in two months.

- Further consolidation of recent losses envisioned on bullish candlestick formation above the key SMA.

- Tops marked in early April, late March add to the downside filters.

Silver (XAG/USD) portrays a corrective pullback while taking rounds to $25.95, up 0.53% intraday, amid Monday’s Asian session. In doing so, the white metal justifies Friday’s trend reversal candlestick formation above 200-day SMA (DMA).

Although the latest recovery eyes to regain the $26.00 round figure, a three-month-old horizontal resistance around $26.65 will test the silver bulls afterward.

Also acting as the upside filter is the $27.15-20 area comprising multiple levels marked since early May.

On the flip side, a daily closing below the 200-DMA level of $25.72 will be probed by April 08 high near $25.60.

However, a clear downside past $25.60 won’t hesitate to conquer the $25.00 threshold while targeting the $24.45-50 area including late-March and early April levels, a break of which will direct silver bears to the yearly low of $23.77.

Silver daily chart

Trend: Further recovery expected