EUR/USD drops towards 100-DMA amid US dollar comeback

- EUR/USD retreats to test the 100-DMA support.

- US dollar rebounds amid risk-aversion, higher Treasury yields.

- The daily technical setup keeps the EUR bulls hopeful.

EUR/USD is extending its correction from two-month highs of 1.2117, now looking to test the 100-DMA support at 1.2055 amid a broad-based US dollar recovery,

Expectations of US President Joe Biden hiking the capital gains to pay for his social plan combined with surging covid cases in the emerging economies and weaker US Durable Goods data have unnerved the markets, with investors rushing to the safe-haven US dollar.

Further, pre-Fed caution trading and downbeat German IFO Survey also add to the weakness in the main currency pair. The Fed is expected to hold its dovish monetary policy stance, although its take on the economic outlook and any hints on tapering plans will be closely eyed.

In the meantime, the focus remains on the US CB Consumer Confidence data and sentiment on Wall Street, in the wake of the key corporate earnings reports.

EUR/USD technical outlook

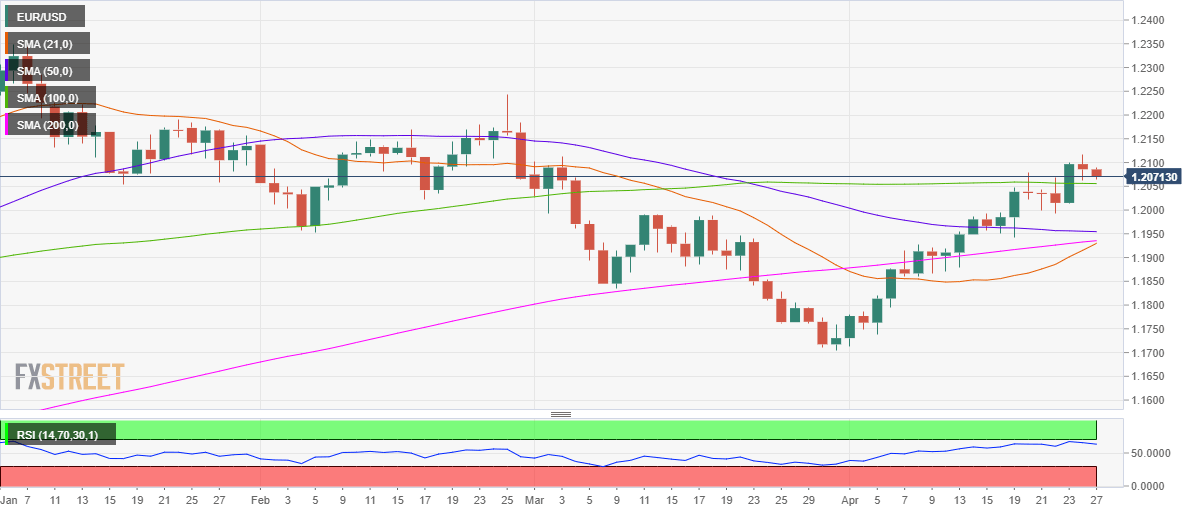

At the time of writing, the EUR/USD pair is pressurizing daily lows near 1.2070, as the bears target the 100-daily moving average (DMA) at 1.2055.

The daily technical setup for the major remains constructive, despite the pullback, as the 14-day Relative Strength Index (RSI) continues to trade above the midline.

Also, an impending bull cross on the said time frame keeps the bullish potential intact. The 21-DMA is on the verge of breaking above the 200-DMA near the 1.1930 region.

EUR/USD daily chart

Therefore, if the 100-DMA support holds, a rebound towards 1.2100 cannot be ruled out in the near term.

On the flip side, a daily closing below that key support is needed to test the downside around Friday’s low of 1.2013.

EUR/USD additional levels to watch