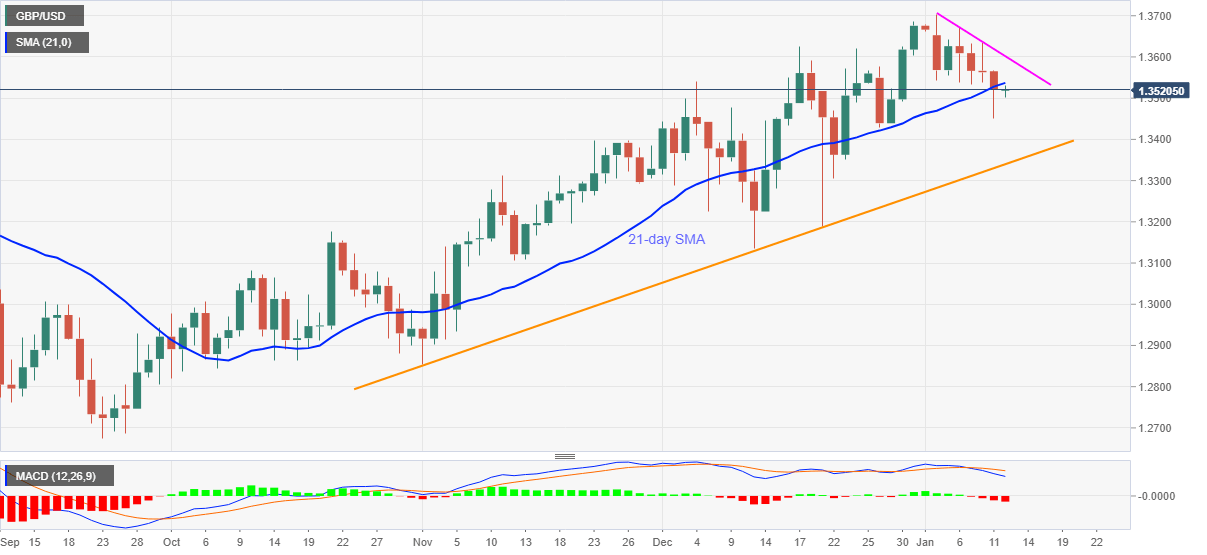

GBP/USD Price Analysis: Keeps downside break of 21-day SMA

- GBP/USD consolidates recent losses after declining to two-week low.

- Bearish MACD, sustained break of short-term SMA favor sellers.

GBP/USD picks up bids to 1.3520 during early Tuesday. That said, the cable pair dropped to the fresh low since late-December after breaking 21-day SMA the previous day. However, the following retracement keeps the quote above the 1.3500 round-figure.

Even so, sellers remain hopeful below 21-day SMA while eyeing the upward sloping trend line from early November, at 1.3340 now.

During the fall between 1.3500 and 1.3340, December 28 low near 1.3430 can act as an intermediate halt.

Should bearish MACD keeps the GBP/USD prices heavy past-1.3340, December low near 1.3135 will be in the spotlight.

Meanwhile, an upside clearance of 21-day SMA, at 1.3538 now, will aim for a downward sloping trend line from January 04, currently around 1.3600.

However, a clear break above 1.3600 might not hesitate to refresh the multi-month high, flashed last week, near the 1.3700 round-figure.

GBP/USD daily chart

Trend: Trend: Pullback expected