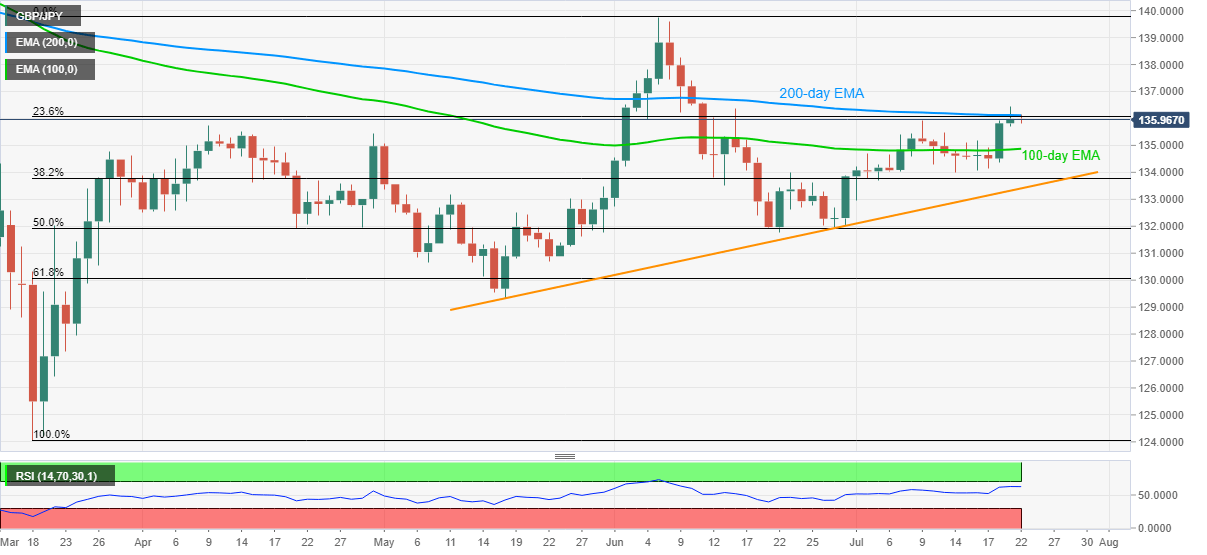

GBP/JPY Price Analysis: 200-day EMA probe bulls attacking 136.00

- GBP/JPY struggles to keep recovery moves from 135.80.

- The key EMA, mid-June top question the buyers cheering break of 100-day EMA.

- Bears may remain cautious unless breaking nine-week-old resistance line.

GBP/JPY recedes from 136.14 to 136.00 amid the initial trading on Tokyo’s bourses during Wednesday. The quote rose to the highest since June 11 the previous day. However, failure to provide a daily closing past-200-day EMA increases the odds of a pullback.

Hence, a 100-day EMA level around 134.85 regains the market’s attention ahead of 134.00 round-figure support. Though, an upward sloping trend line from May 18, at 133.40 now, will question the bears afterward.

In a case where the GBP/JPY prices remain pressured below 133.40, 50% and 61.8% Fibonacci retracements of the March-June upside, respectively around 131.90 and 130.65, could entertain the sellers before diverting them to May month’s bottom near 129.30.

On the contrary, a 200-day EMA level of 136.15 and June 16 peak surrounding 136.35 can restrict the pair’s immediate upside ahead of 137.00 resistance level.

During the quote’s rise past-137.00, 137.40/45 and 138.80 might offer intermediate halts prior to pushing the bulls to June month’s top surrounding 139.75, followed by 140.00 threshold.

GBP/JPY daily chart

Trend: Pullback expected