Gold Price Analysis: XAU/USD bears seek validation of monthly support line break below $1,800

- Gold prices struggle to consolidate the biggest losses in six weeks around $1,797.

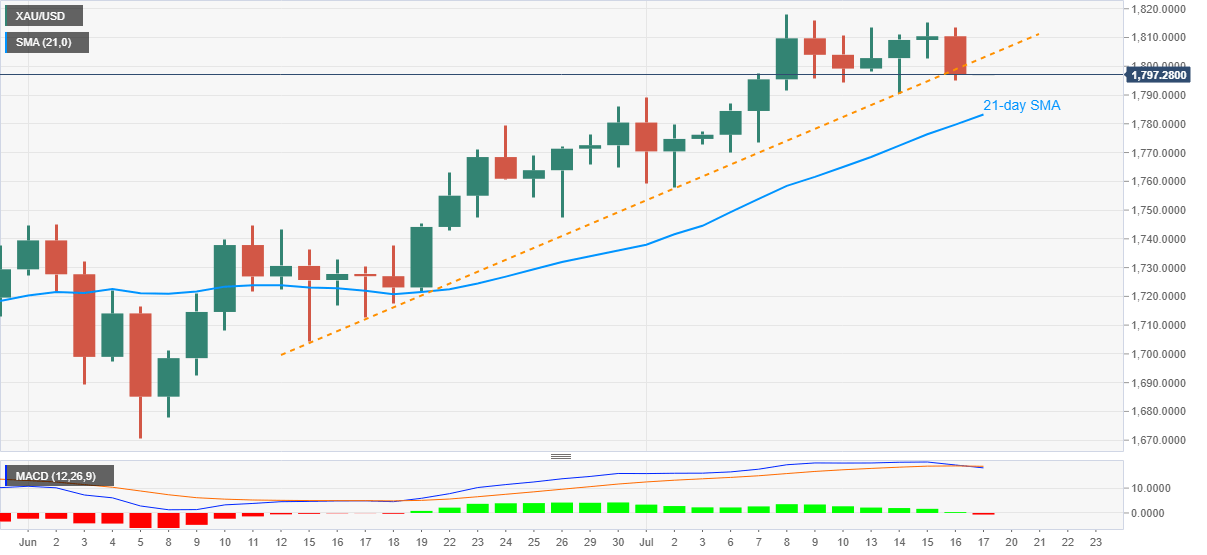

- Bearish MACD, break of short-term ascending trend line keeps the sellers hopeful.

- The month-start top, 21-day SMA offer nearby key support.

Gold remains sluggish around $1,797 amid the early Friday morning in Asia. The bullion broke an upward sloping trend line from June 15 while marking the heaviest losses since June 05 the previous day. The resulted move also drags the MACD to flash the first bearish signal in a month. However, the sellers are waiting for a confirmation of the latest weakness near a few more short-term key supports.

The July 01 top near $1,789, followed by 21-day SMA surrounding $1,783, becomes the nearby rest-points that the bears can avail.

Though, the precious metal’s weakness past-$1,783 will be important as it can recall the early-June peak close to $1,745.

Meanwhile, buyers can see the support-turned-resistance line of $1,803 as an adjacent upside barrier, a break of which could again propel the quote towards the multi-year top, flashed on July 08, near $1,818.

During the commodity’s rise past-$1,818, $1,840/45 region could offer multiple resistances ahead of extending the north-run towards the record high beyond $1,900.

Gold daily chart

Trend: Pullback expected