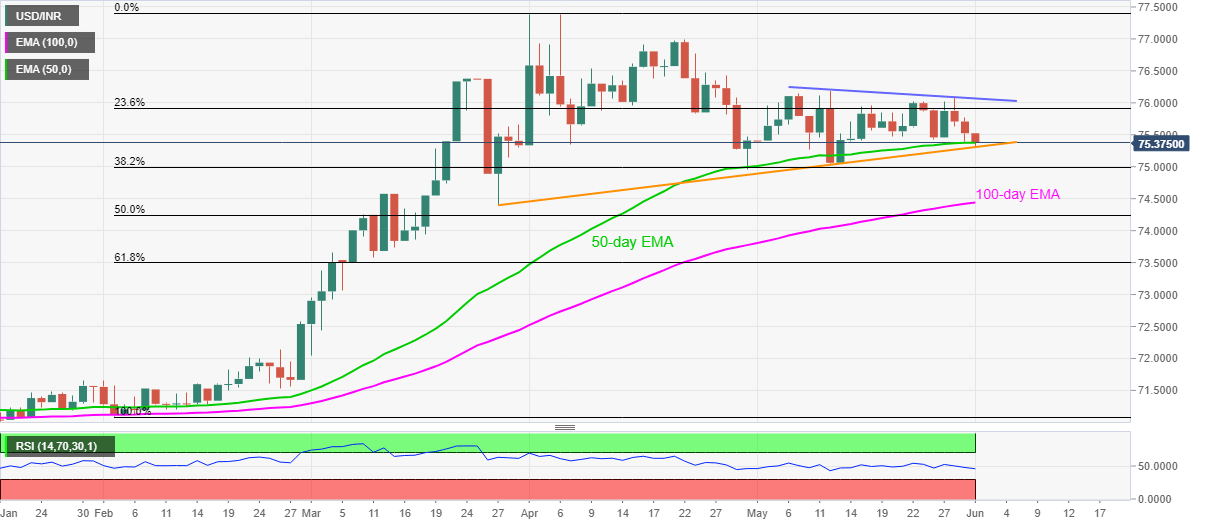

USD/INR Price New: Indian rupee probes 50-day EMA, two-month-old resistance line

- USD/INR drops to 13-day low while flashing three-day losing streak.

- Indian PM Narendra Modi to chair special cabinet meeting, big decisions are expected amid coronavirus outbreak in the Asian nation.

- A sustained break of near-term key support will highlight late-March low, 100-day EMA for sellers.

- Bulls will look for entry beyond three-week-old resistance line.

USD/INR drops 0.20% while flashing 75.38 as a quote amid Monday’s initial Indian session. While bearish MACD and a three-week-old falling trend line keep the buyers away, a confluence of 50-day EMA and a two-month-long rising support line is likely challenging the bears for now.

As a result, further selling pressure could be expected if the pair registers a daily closing below 75.30, which in turn will drag the USD/INR prices towards 74.45/40 support zone comprising 100-day EMA and March 27 low.

Additionally, the pair’s further selling past-74.40 might not hesitate to visit 61.8% Fibonacci retracement of February-April upside, at 73.50.

Meanwhile, buyers are less likely to enter any long positions unless the pair crosses the immediate resistance line, at 76.07 now, on a daily closing basis.

In doing so, May month high near 76.20 and April 22 to close to 77.00 will be in the spotlight.

USD/INR daily chart

Trend: Pullback expected