Back

12 May 2020

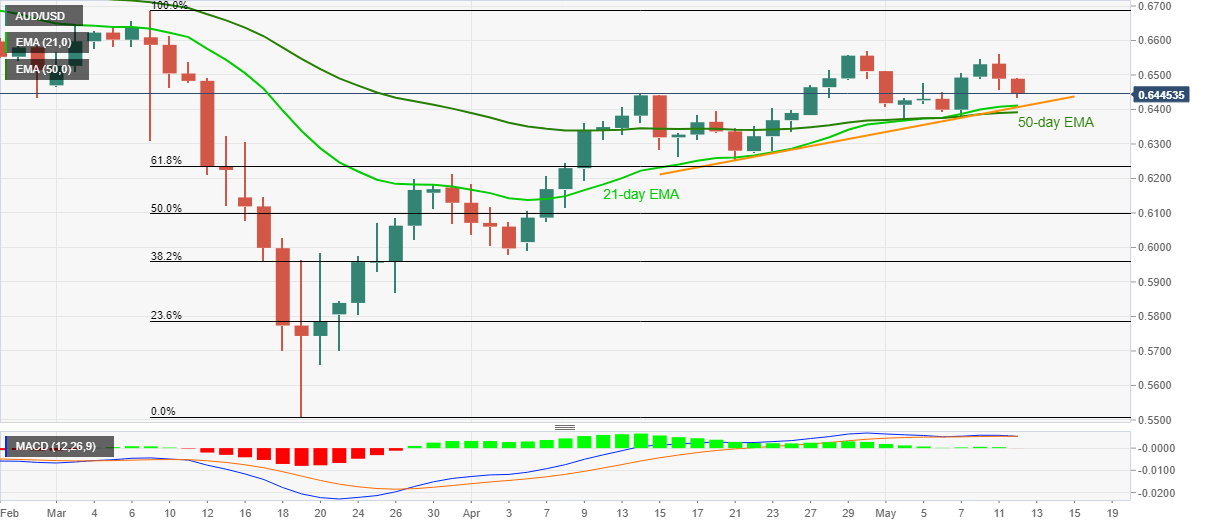

AUD/USD Price Analysis: Drops further below 0.6500 ahead of China data

- AUD/USD refreshes three-day low ahead of China CPI/PPI data.

- 21-day EMA, three-week-old support line and 50-day EMA are on sellers’ radars.

- Buyers will look for entries beyond April 30 top.

AUD/USD drops to 0.6435, down 0.81% on a day, during Tuesday’s Asian session. That said, the pair traders await China’s headline inflation figures while nearing the short-term key supports.

Among them, a confluence of 21-day EMA and an ascending trend line from April 21, near 0.6410/05, seems to be the first in limiting the pair’s further downside.

Should sellers dominate below 0.6405, 50-day EMA near 0.6390 offers another challenge to them before diverting the moves toward late-April low near 0.6250.

Alternatively, April 30 high close to 0.6570 acts as the immediate key resistance for the buyers to watch, a break of which could escalate the recovery moves towards March month high near 0.6690.

AUD/USD daily chart

Trend: Pullback expected