GBP/USD is holding ground following the Fed announcements

- Fed on hold for foreseeable future, but monitoring "incoming data including Global developments in muted inflation pressures."

- GBP/USD vulnerable to key support structure ahead of crucial PMI.

- Powell is not comfortable with inflation persistently below 2%.

GBP/USD has been holding within a range of between 1.2989 and 1.3029, slightly higher on the US session following the Federal Reserve's announcements whereby the central bank is on hold, albeit watchful of "incoming data including Global developments in muted inflation pressures."

Powell is now speaking and he has said that he is not comfortable with inflation persistently below 2% – that's dovish.

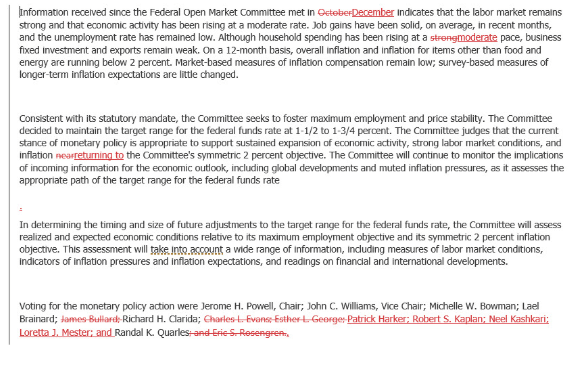

FOMC keeps rates unchanged

- Target rate remains at 1.5% to 1.75%.

- Interest rate on excess reserves 1.6% versus 1.55%.

- The decision is unanimous.

- Fed says labor market stronger, economy rising at moderate rate.

- Consumption moderate, investment and exports week.

- Job gains solid, unemployment has remained a low.

- Overall and core inflation running below 2%.

- Fed leaves discount rate at 2.25%.

- Market-based gauges of inflation compensation remain low.

- Aims for inflation returning to symmetric 2% goal.

- Reiterates plan to buy treasury bills into 2nd half of 2020.

- Continue to conducting Terman overnight repo operations at least through April.

- Survey based inflation expectations a little changed.

- Current policy appropriate to sustain expansion.

- Will continue to monitor incoming data including Global developments in muted inflation pressures.

There was a dovish tilt to the meeting and announcements within the statement, but there really isn't that much change to it.

Changes to statement

BoE on hold? A lot depends on the PMIs

Meanwhile, this Friday, we will have PMI data. This will be critical ahead of the Bank of England meeting tomorrow. Both Monetary Policy Members, Tenreyro and Vlieghe, have joined the choir of members signing a dovish tune of late and who have been very specific about these forthcoming reports.

On the PMI front, should the surveys rebound, it has been made clear with a great deal of emphasis on the data, that the Bank of England could well hold-off. A rate cut following a rebound in the Composite reading would be peculiar.

GBP/USD levels

Bulls have lost their mojo on the charts and have taken a trip to the downside below a 23.6% Fibo retracement of the October rally. Bars are back on control on the pursuit of a 38.2% Fibo towards 1.2918 and a key support structure.