Natural Gas Price News: Bouncing at critical support amid deadly winter storm

- Prices of natural gas have been declining in recent days.

- Unusually hot winter weather has motivated hedge funds to short NG prices.

- The Natural gas futures chart is showing critical uptrend support has been reached.

Cold weather pushes prices of Natural Gas higher every winter as if the cold season is a surprise. Nevertheless, the heating commodity requires genuinely cold weather to advance. Prices peaked in early November in response to an abnormally cold spell that came early.

However, the mercury dropped later last month, pushing prices lower once again. The Henry Hub Natural Gas Futures for the end of the year hit a low of $2.42, matching levels seen in late October. According to reports, hedge funds have been shorting prices amid the heatwave, but they may have been mistaken.

Temperatures have changed once again, with a deadly winter storm causing air traffic issues and covering California with snow. After disrupting Thanksgiving, snowstorms are set to continue and may push prices higher.

Natural Gas Price Today – support holds

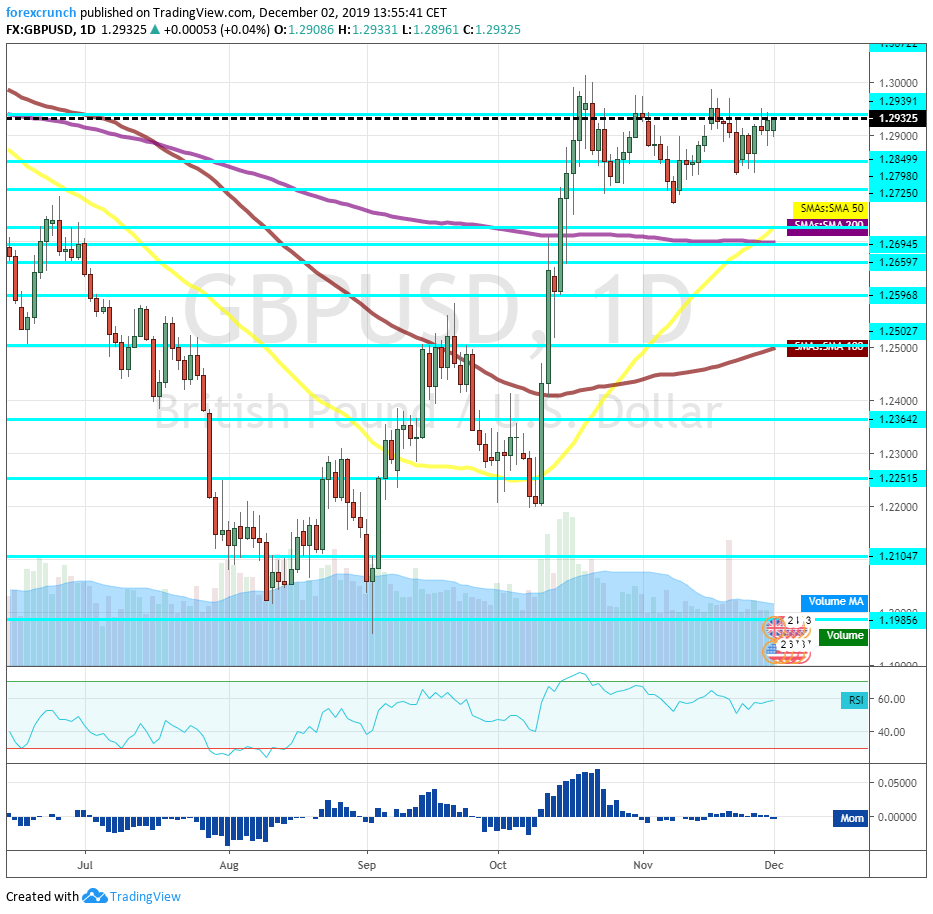

The Henry Hub Natural Gas Futures for December had bounced at a critical level – uptrend support that had accompanied prices since August when they bottomed at $2.35. That line was formed in mid-October when NatGas hit $2.387. The bounce at this line provides hope for the bulls.

Looking up, resistance awaits at $2.50, which is a round number and also a low point in late November. Further above, the gap area between $2.71 and $2.75 is a critical region. The upside target is the November peak of $2.96.

Natural gas prices are set to follow North American ahead of the busy Christmas season when families gather together and desire to stay in warm houses.