EUR/USD stays below 1.1100 on German docket

- EUR/USD hovers around 1.1090/80 after German data.

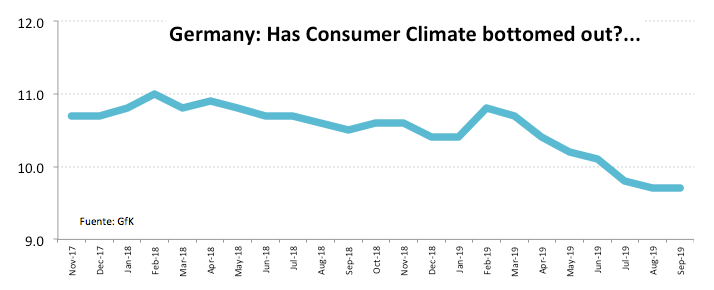

- German Consumer Climate came in at 9.7 in September.

- Trade and yields keep ruling the global mood.

The single currency remains unable to gather traction in any direction today, with EUR/USD parked around the 1.1090/80 for the time being.

EUR/USD attention shifts to trade, yields

Spot is down for the third session in a row on Wednesday, negating Friday’s bullish ‘outside day’ and re-shifting its attention back to the lower end of the recent range.

US-China trade concerns remain unabated and continue to drive the sentiment in the global markets, exacerbating investors’ hunt for safer assets and driving global yields lower.

In the meantime, EUR posted to reaction after Italy seems to have averted snap elections for the time being, as the M5S and the PD have resumed talks to form a coalition government. At the same time, both parties agreed to reinstate G.Conte as Prime Minister.

In the euro-calendar, German Consumer Climate tracked by GfK came in at 9.7, a tad above estimates albeit unchanged from the August reading. Further data in Germany saw Import Prices contracting 0.2% in July and 2.1% from a year earlier.

Nothing worth mentioning in the US docket, with MBA’s Mortgage Approvals due later seconded by the EIA’s report on US oil supplies and speeches by FOMC’s T.Barkin and M.Daly.

What to look for around EUR

Spot remains on the defensive against the backdrop of increasing trade concerns and declining bond yields. While the situation in Italy has improved considerably in the last hours, the final word is yet to be said. In the meantime, ECB’s preparations for a fresh wave of monetary stimulus (most likely to be announced in September), including a potential reduction of interest rates, the re-start of the QE programme and a probable tiered deposit rate system, continues to weigh on EUR and caps any bullish attempts in the pair.

EUR/USD levels to watch

At the moment, the pair is retreating 0.04% at 1.1085 and faces immediate contention at 1.1051 (low Aug.23) ahead of 1.1026 (2019 low Aug.1) and finally 1.0839 (monthly low May 11 2017). On the flip side, a break above 1.1129 (21-day SMA) would target 1.1186 (61.8% Fibo of the 2017-2018 up move) en route to 1.1203 (55-day SMA).