Back

11 Sep 2018

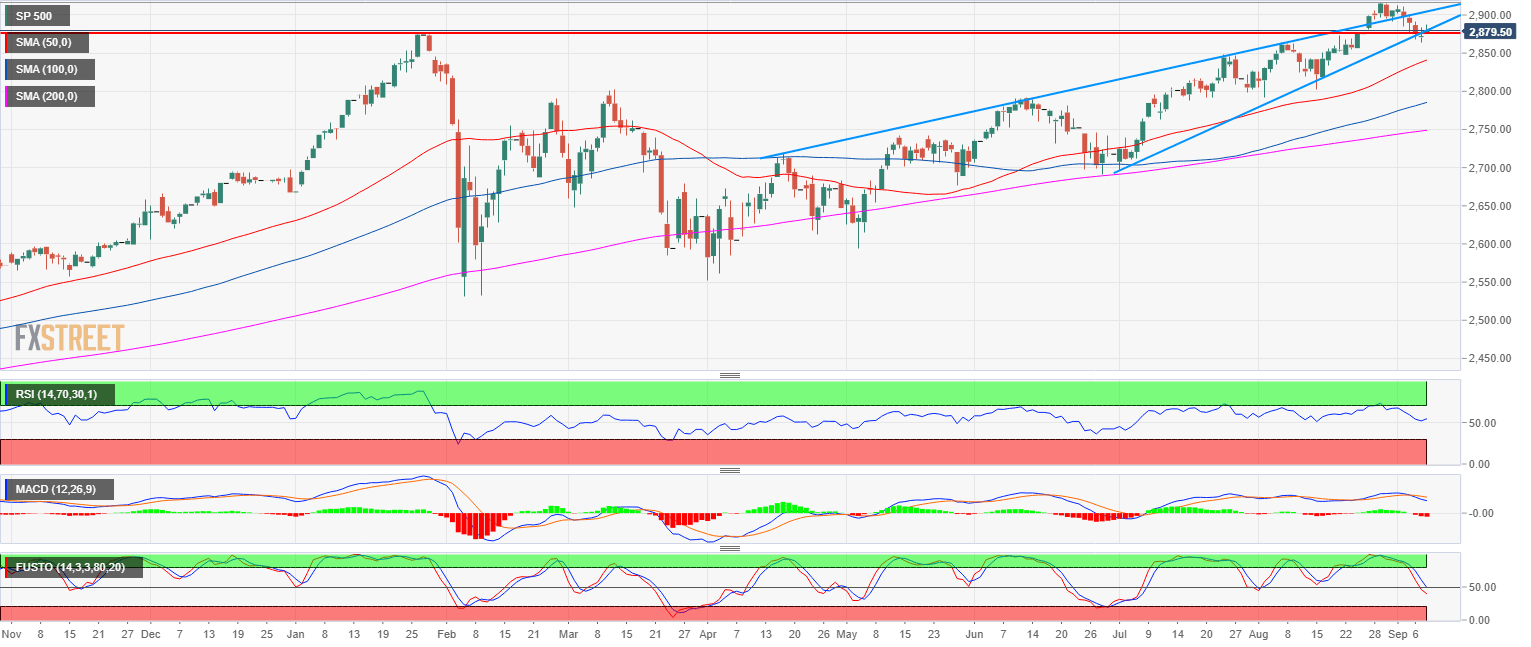

S&P500 Technical Analysis: Deeper correction can be around the corner

- The S&P500 Index is in consolidation phase after making new all-time-highs in the last weeks.

- The Index is holding above 2,877.00 January swing high and the bull trendline which is rather bullish.

- However, the RSI, MACD and Stochastics indicators are starting to show some sign of weakness and a deeper correction might be just around the corner with 2,853.00 (August 9 low) as support to the downside.

S&P500 daily chart

Spot rate: 2,879.50

Relative change: 0.25%

High: 2,888.00

Low: 2,876.00

Main trend: Bullish

Resistance 1: 2,900.00 figure

Resistance 2: 2,917.00 all-time-high

Resistance 3: 2,930.00 figure

Resistance 4: 2,950.00 figure

Support 1: 2,877.00 January swing high

Support 2: 2,863.75 August 7 high

Support 3: 2,853.00 August 9 low