USD/CAD rises further to 1.3150, extends weekly gains

- Loonie among worst performer of the American session, retreats across the board.

- USD/CAD hits fresh 2-week highs near 1.3150, heads for best week since June.

The USD/CAD pair rose further during the American session and near the end of the week, it was hovering around 1.3142/47, at the highest level in two weeks. The Loonie dropped further versus the US dollar and trimmed gains versus other currencies.

The Loonie lost momentum following the release of Canadian data and remained weak during the rest of the session. Statistics Canada released the July employment report that showed an increase in employment by 54.1K and a decline in the unemployment rate to 5.8% from 6%, after a decline in the participation rate to 65.4%. The details of the report showed that full-time jobs dropped by 28K and part-time rose by 82K. “All in all, this morning’s LFS report supports our view that the Bank of Canada will want to wait at least until October for its next rate hike to get more visibility on the Canadian fiscal update and trade uncertainty,” wrote analyst at NBF.

In the US, CPI data came in line with expectations, showing a gain of 0.2% in July. The core rate hit the highest annual rate since 2008 at 2.4%. The greenback was unaffected by the data. The situations in Turkey was the main driver of today’s price action. Risk aversion boosted the demand for the US dollar.

Outlook

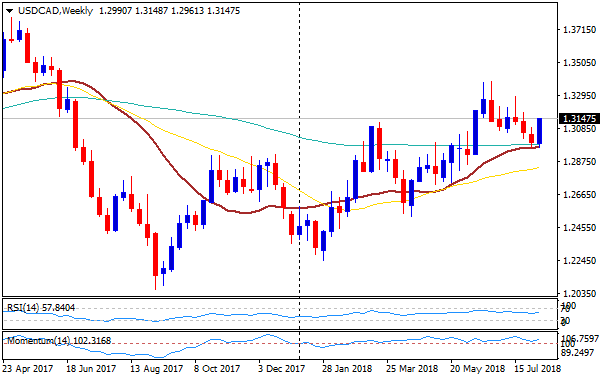

The USD/CAD pair is posting weekly gains after falling during the previous three and is having the best performance since June. The decline that started weeks ago found support at the weekly 20-SMA. Technical indicators turned to the upside suggesting that more gains are likely over the next sessions. The bullish bias is likely to remain strong as long as the pair holds on top of 1.3050/60.